Want to know how to buy a house with bad credit? Well, purchasing a house on its own can be overwhelming, talk less of buying with it with bad credit – low credit. That can be a real hassle. When purchasing a home, the buyers are required to have money for a down payment, a history of bill payment for at least two years, a steady source of income, and a credit score requirement. Although a higher credit score may help in earning favorable loans, it is still possible to buy with bad credit.

Moreover, this post contains a summary of ways of buying a house with bad credit, what credit scores are, and how to improve them. Read on to find out more.

What is a Credit Score?

A credit score is any number from 300-850 that gives information about your financial performance. It is made up of your payment history, amount of debts, the total of open credit account, length of credit history, and recent credits.

This score changes over time as your credit history changes, for instance, if you get a new loan or default in your loan payment. According to financial expert, Andrew Declan, it is possible to have more than one credit score without your credit history changing. “This is because different financial institutions use different methods for calculating credit scores”, he says.

There are two kinds of credit scoring systems approved by most financial institutions. In addition to this, the upper and lower limits of the scores are the same but differ in the percentage allocated to credit history. There is the FICO scoring system and the Vantage scoring system.

FICO

The FICO credit score system is the commonly used system, and you can determine it by;

Payment history – 35%

Amount owed – 30%

Length of credit history -15%

Number of credit account -10%

New credit -10%

The results are grades into;

Poor – 300-579

Fair – 580-669

Good – 670-739

Very good – 740-799

Excellent – 800-850

Vantage Score

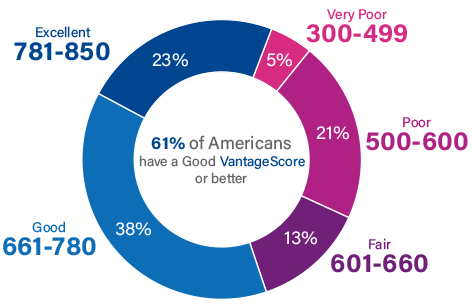

With a vantage scoring system, you don’t need to have a credit history to get a credit score.

Payment history – 40%

Depth of credit – 21%

Credit utilization – 20%

Balances -11%

Recent credit – 5%

Available credit – 3%

Credit scores are graded into;

Very Poor – 300-499

Poor – 500-600

Fair – 601-660

Good – 661-780

Excellent- 781-850

When a Credit Score is Thought-Out to Be Bad Credit?

“In all my years as a credit analyst, I realized that most lenders don’t have a specific minimum credit score”. Each of them is free to set their minimum, Declan said. The majority of borrowers don’t know this. However, government-backed loans have a credit score minimum, which serves as a benchmark for other lenders.

According to the FICO system – which is the most used credit scoring system, bad credit is a score below 580.

Buying A Home With Bad Credit

“Over the years, I tell people who come to me for help that buying a house with bad credit is not as impossible or as difficult as they think. You just need the right information”.

There are four ways as how to buy a house with bad credit – below 580 – all government-backed. It can either be FHA loans, VA loans, USDA loans. There are also conventional loans with exceptions.

Conventional Loans With Exceptions

First of all, the conventional loan has nothing to do with the government – at least not directly says Declan. They are sold to government ventures (Fannie Mac and Freddie Mac), who in turn sell them to investors. Buyers need to pay a down payment of 3% for first-time buyers or 5% for non-first-time buyers. For a non-single family home, it is 15% and 10% if it is your second home. To enjoy this, you need a score of about 600, but there are exceptions.

“Most time I advise people to go for this kind of loan if their income is higher than the loan amount or the down payment”. Thus, in such a case, you are likely to be having the advantage of getting a conventional loan.

FHA Loans (Federal Housing Administration)

FHA is another way to buy a house with bad credit. It gives a mortgage to buyers with a credit of 500. Further, it’s a government-sponsored loan that only allows the purchase of a primary residence. This means that your lender is having all the protection from loss in case you default from payment.

Additionally, other requirements include; you must take up residence there within 60 days of closing and there must be a property inspection to meet the minimum required standard.

VA Loan (Veterans Affairs)

VA loans are ways veterans or those currently serving the military can a house with bad credit. They buy a house with zero USD down payment but sometimes you may require paying a one-time funding fee.

To qualify for this, you must have; served 181 days at peacetime, 90 days during war, or 6 years as National Guard. Also, spouses of veterans who lost their lives in the line of duty can enjoy this as far as they are not remarried.

USDA Loans

The power of USDA loans lies in the hands of the “United States Department of Agriculture.” It is a single housing guaranteed loan for families with low or moderate families in rural areas. Also, there’s no requirement of a down payment and a charge of only 1% interest rate is there.

If You Cannot Buy A Home With Bad Credit, Here’s What to Do

If you still cannot obtain a mortgage with your credit score, you should work on repairing your credit. There are ways to go about it

· Boost your possible credit to increase your credit utilization

· Open new credit card accounts for raising your available credit along with your credit mix

· Get a co-signer to boost your credit. In this, you can consider both your asset and income together.

·Avoid hard credit inquiry

·Pay for collections to be deleted. Collections are how much you owe a lender and are yet to pay back. Even when you do, it reflects as paid but it is more preferable to have it deleted.

Expert’s Say on This!

When the credit score is below 670 FICO score, according to experts, it’s bad. More specifically, a score of below 580 is bad credit. But despite this, there are other factors lenders consider like the down payment, overall debt, income, etc. In other words, cash is the deciding factor if your credit is bad and you want a house. Your score will qualify you for a certain mortgage amount, you’d have to pay out of pocket to cover the difference.

Furthermore, in case you want to buy a house but do not know your credit score, you can check your credit score from credit score bureaus.

We hope, this guide on how to buy a house with bad credit with help you in buying your dream project!