Do you love shows like Flip or Flop on HGTV or Flip Wars on A&E? These shows focus on how to buy a house at auction and flipping it.

While you may dream of being the next Christina Hall (formerly El Moussa), you also may be wondering how to buy a house at auction without cash… You’re not alone.

How exactly do these home flippers buy homes at auction when most of these home auctions expect you to pay for the home upfront in cash?

Most people don’t have enough cash to buy a home just sitting in their bank accounts.

So, the question is, can you buy a house at auction without cash?

The answer is yes, but it is complicated.

This post is all about how to buy a house at auction without cash.

What Are Home Auctions?

Home auctions are simply what the name suggests – homes sold at an auction.

Typically, they take place on the first Tuesday of each month at the local courthouse.

Real estate buyers (or investors) show up to home auctions and place bids on available auction homes.

The winning bid is traditionally the highest bid.

Part of the appeal of buying a home at auction is the ability to save money.

According to Home Selling Expert, “Houses sold at auction tend to achieve much higher prices now than they used to. They can sell for as little as 70% of their market value, but can sell for as much as 10% more than market value. The average is about 85-90%.”

But one of the common requirements when buying a home at auction is that you will need to pay immediately using cash, so even if you get it for less than market value, you will still need to have the full total upfront.

Can you buy a house at auction without cash?

Keep reading, and we will explain how you can buy a house at auction without cash.

What Are Cash Only Auctions?

Most real estate home auctions only accept cash offers.

This is because home auctions generally have short closing windows, which do not allow for enough time to obtain traditional bank financing.

This means that if you do not go to the option with cash in hand, you most likely don’t stand a chance.

In order to qualify as a cash buyer, you must pay for the property that day or within a specified amount of time after placing the winning bid.

How much you need to pay upfront depends on the auction.

Some auctions require the full price right away. Others require you to pay a small deposit in cash immediately and then pay the remaining balance within a set amount of time.

So how to buy a house at auction without cash requires utilizing different real estate auction financing.

Why Are Homes Sold This Way?

Generally, homes are auctioned once the homeowner can no longer pay their mortgage or property taxes.

Foreclosed homes or pre-foreclosed homes are typically sold at auction.

That means there tends to be a good number of homes being sold at auction at any given time.

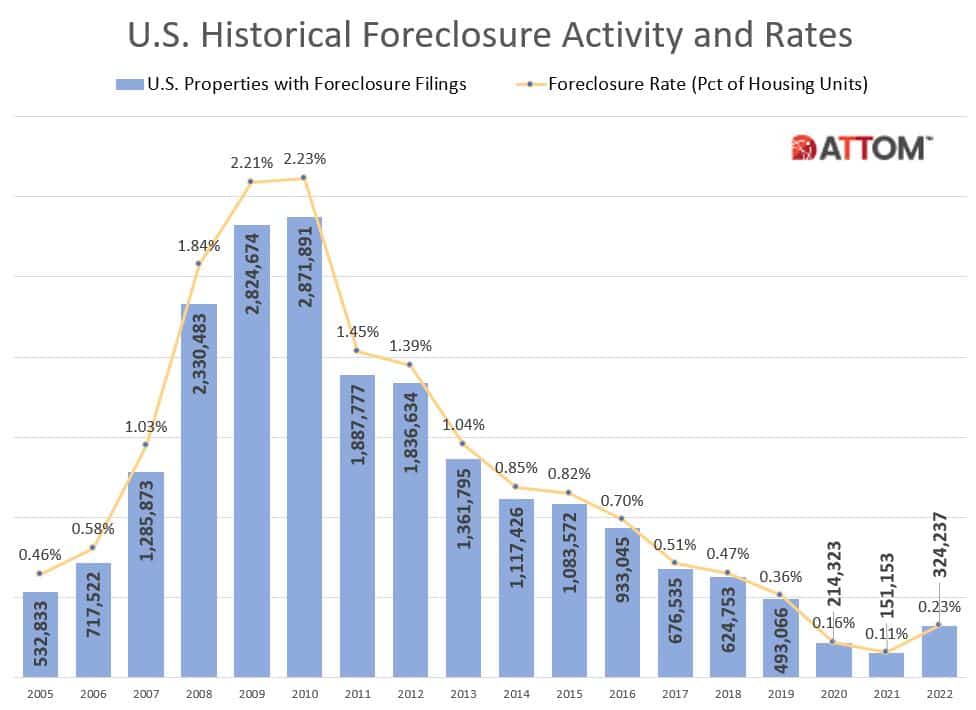

According to ATTOM, “[The] Year-End 2022 U.S. Foreclosure Market Report, which shows foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 324,237 U.S. properties in 2022, up 115 percent from 2021 but down 34 percent from 2019, before the pandemic shook up the market.”

Source: Attomdata.com

A large number of the 324,237 foreclosed homes in 2022 were sold at auction.

For example, in February 2023, San Diego CBS reported, “With soaring home prices out of reach for so many home buyers, some people are turning to county auctions to find bargain properties. Every year, the county auctions off properties that are in default for unpaid taxes, and this year, there are 421 properties for sale. These include more than 50 residential and commercial properties, 300 timeshares, and 70 undeveloped parcels of land.”

Different Types Of Home Auctions

There are three different types of home auctions.

(1) Absolute Auction: In this type of auction, the highest bidder wins. Period. This means someone could bid $1 and win a home. All sales are final.

(2) Minimum Bid Auction: In this type of auction, there is a minimum bid determined for the property. This price is published in advance of the auction. The minimum bid is the starting bid. Generally, this minimum bid is calculated based on the balance owed on the mortgage or for property taxes.

(3) Reserve Auction: In this type of auction, the seller does not reveal what he or she will accept as a minimum bid. In these cases, bids are treated more like traditional offers on a home. As a result, the seller may reject a bid that is lower than his desired minimum.

6 Ways To Buy A House At Auction Without Cash

After knowing all about how home auctions work, we arrive back to our initial question: Can you buy a house at auction without cash?

The answer is yes. There are six ways actually.

Let’s look at how to buy a house at auction without cash.

#1 Borrow From Hard Money Lenders

One way to buy a house at auction without cash is to borrow from hard money lenders locally.

Hard money loans are issued by private investors or companies.

They base their decision on whether to lend you money based on how good of an investment the property is.

If you can present the potential hard money lender with property details before the auction, the lender may approve a loan.

It is important to understand that these types of loans make the lender money by charging higher interest rates and upfront fees than banks.

#2 Seek Peer-To-Peer Lending Or A Private Loan

You may also consider reaching out directly to those in your circle to see if anyone would be willing to give you a private loan.

You can also consider a peer-to-peer lending platform, such as Upstart. If you use a platform like this one, you will need to meet certain criteria (such as a good credit history).

#3 Use A Personal Loan

If you have good credit and a steady income, you may want to consider using a personal loan to buy a house at auction without cash.

However, it is important to recognize you will pay higher interest rates on this type of loan.

#4 Finance The Home

See if the buyer will accept installments or monthly payments for a certain period of time.

In this situation, you will pay the seller directly without a third party.

In most cases with financing a house at auction, you will be required to pay a deposit upfront and then determine a set amount of time to pay the installments.

#5 Consider Home Equity Loans

Homeowners may be able to secure a home equity loan or line of credit using their home’s equity.

If so, you can take the amount from the home equity loan to pay for the home bought at auction.

These types of loans tend to have better interest rates than hard money lenders and offer more cash than peer-to-peer lending platforms.

But a home equity loan can also be risky. If you can’t make your payments, your current home could become a foreclosure.

#6 Look For A Fast Mortgage Bank Loan

Typically, how to buy a house at auction without cash does not involve traditional bank mortgages.

This is mainly due to time.

If you can find a mortgage lender that is willing and able to move faster than the traditional thirty days, it may be worth it.

Pros And Cons To Buy A House At Auction Without Cash

At this point, you may be getting more excited as you consider how to buy a house at auction without cash.

We promise to reveal how to score a home at an auction without a wad of cash in hand.

Before we get there though, it is important to understand the pros and cons of these types of home purchases.

Pros

- It’s quick: If you bid and win, the property now belongs to you.

- No negotiation hassles: The sellers want to get these properties off their books and don’t want to go back and forth like traditional buyers and sellers.

- No issues with titles: If the bank or government is selling the home at an auction, it means there is a clear title and no debts.

Cons

- Initial cash purchase: Again, we’ll explain how to address this issue, but we’d be lying if we said it isn’t a con.

- Homes sold “as is”: What you buy is what you get. You don’t get to walk through or seek an appraisal. This means you may have to make some serious renovations. Those home-flipping shows weren’t making this part up.

- Fees and commissions: The winning bidder is responsible for paying real estate auction fees.

- Miss out on common protections: In traditional home buying situations, buyers are offered consumer protections, such as lenders being required to make disclosures. This is not a requirement with home auctions.

Understanding Home Auction Rules

It would be unwise to show up to a home auction without understanding how they work.

For example, while we are focusing on how to buy a house at auction without cash, it doesn’t mean you should expect to see other potential bidders with suitcases full of cash.

Different institutions have different processes for home auctions.

Government real estate home auctions take place on the first Tuesday of every month at the local courthouse.

Other foreclosed home auctions may require bidders to register before the event.

Since most home auctions are cash only, you must show proof you have the cash to pay the winning bid in total.

Often, people use a cashier’s check.

But many auctions require you to prequalify before they even allow you to bid, which means you’ll need to show you have the ability to pay.

This may look like providing a credit card.

It is also important to know what type of auction it is. It will be disappointing to show up thinking they have open bids only to find out the minimum bid is more than you can afford.

Before you head to a home auction, do your homework.

Conclusion

Can you buy a house at auction without cash? Yes!

If you have dreams of flipping a home or simply want to purchase a new home for a steal, it is possible to buy a house at auction.

Knowing how to buy a house at auction without cash is the key to finding and securing the means to walk away with a title in hand. Just remember to do your homework and look for auction financing.

Follow these steps above and you’ll be acquiring that new property in no time. Good luck!

Here at Penny Calling Penny, our home buying blogs are only a part of our growing library. We’re dedicated to helping you learn how to buy a home, no matter where you’re at on your financial journey. Subscribe to our newsletter so you never miss a Penny, and we’ll see you next time!