Credible

Trustpilot Rating – 4.5/5

It is a marketplace for students to search and compare loan offers from various providers. It has a star rating of 4.7 on Trustpilot and has provided for more than 2 million users. It functions with loan providers such as Ascent, Invested, College Ave, Sallie Mae, EDentinU, Ascent, Citizens Bank etc.

Zero Processing Fee

No Impact on Credit Score

Easy to Apply

Loan Options for International Students

Are you looking for student loans? Perhaps you are looking to compare and find the best student loan refinance rates. A student loan can be the best financial tool to help you achieve your academic goals. It offers the convenience and flexibility to pay your school fees and cover expenses without a hassle. You can get student loans through the federal government or private lenders. The latter can be from a bank, credit union, school, or state agency.

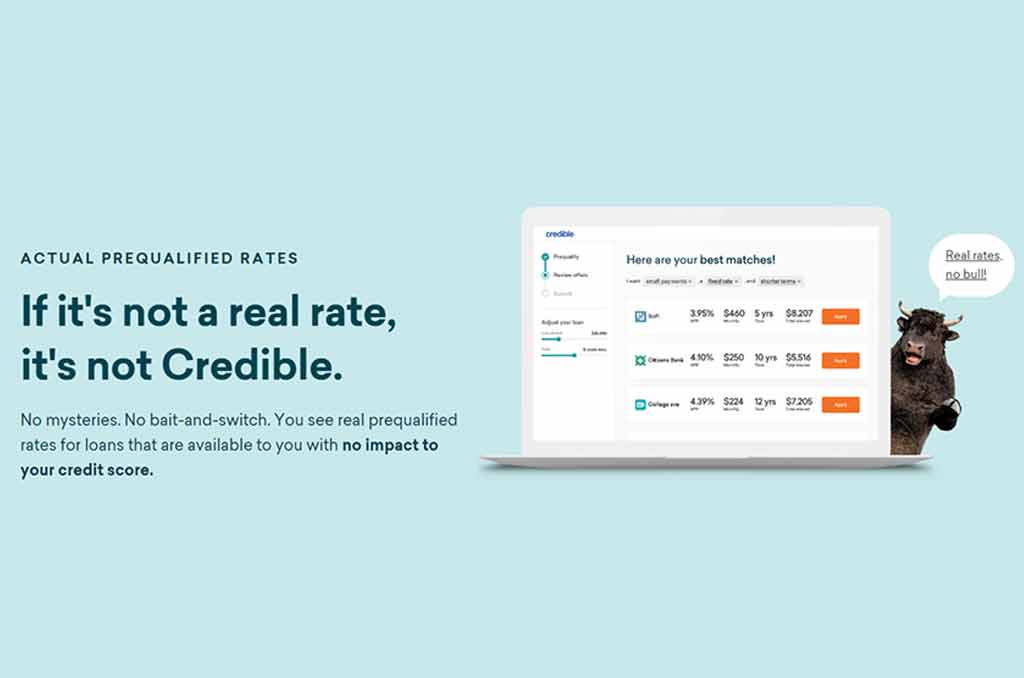

However, finding the best student loan lender that fits your needs can be quite an uphill task. Hello, Credible, an easy way to find the perfect match for your student loans online. Credible is an online student loan marketplace that connects you with the right lender and helps you get the best student loan rates. Let’s dive deeper into this Credible student loan review and how you can get your next student loan or refinance.

Is Credible Legitimate?

Credible is a legitimate online marketplace where you can search and compare student loan offers from different lenders. They don’t charge you even a dime to use Credible; however, they do receive a small commission when you take a loan from one of its partners.

Credible boasts an average star rating of 4.7 on Trustpilot from over 5,000 customers. Credible has served over two million consumers looking to compare loan rates and find the best lender. Furthermore, Credible provides other loan products, including student refinancing, personal loans, home loans, mortgage refinancing, and insurance.

Student Loan Refinancing

Student loan refinancing is an ideal way to get better interest rates and repayment terms. This strategy can help you save thousands of dollars and lower monthly payments. Furthermore, it can help you pay your student loans faster through short-term refinancing. Another option is the long-term student refinance loan, which can lower your monthly payments.

Refinancing student loans also allow you to use a cosigner, which is a perfect idea if your credit score is low.

Getting a provider that fits your money goals can be quite challenging. Credible can match you with the best student loan refinance rates to meet your goals. You refinance your student loan even if you never graduated. Credible can provide an option for private, federal, or Parent PLUS student loans.

How Do Credible Student Loan Refinance Work?

Credible provides a hassle-free online marketplace for students and parents to shop for private student loan refinance. It is 100% free to search for education loans, and there are no origination or prepayment penalty fees. You take three no-brainer steps to find the right lender for you. First, you fill out a form, review multiple student loan offers, pick one that works for you, and complete your application.

Credible takes pride in providing the best student loan interest rate and backs this up with $200 if you can’t find the rate on their site.

Do You Need A Credit Cosigner To Qualify For A Student Loan Refinance On Credible?

A student loan cosigner is someone willing to help you pay a part of or the entire loan amount should you fail to settle it. Ideally, you’ll need a cosigner if you don’t have a credit history. It can be one of your parents/guardians, relative, friend, or spouse. One advantage of having a cosigner is that you can get excellent loan rates if your cosigner has a qualifying credit score.

You can prequalify for a student loan refinance on Credible without a cosigner. However, your chances of snagging the best student loan rates are three times high when you have a cosigner. Undergrad students use cosigners for 90% of student loans on Credible. You can use Credible to compare your cosigners and choose the one that can get you the best loan deal.

Eligibility For Student Loan Refinance

With Credible, you’re eligible to refinance graduate, graduate, and professional student loans. Whether you need to refinance federal student loans, private, medical school, law school, or MBA student loans, you can find the best refinance lender on Credible.

Does Credible Offer Private Student Loans?

Whether you’re a student or a parent needing a student loan, Credible has got you sorted. They provide various student loan products to fit your program needs.

1) Undergraduate Student Loans

Enrolling for your undergraduate degree can be exciting and Credible ensures you get the funds you need for your school fees and expenses. They can find you the best loan provider in terms of interest rate, repayment, and benefits regardless of your academic program.

2) Graduate Student Loans

Do you need a boost for your graduate studies? Credible can make it easy for you to compare up to eight student loan lenders. You can use graduate student loans to pay for your tuition, books, and living expenses.

3) MBA Student Loans

Are you planning to enroll for a Master of Business Administration and need a loan? Credible provides the best options for MBA student loans. There are no application fees, disbursement, or origination fees when you apply for an MBA student loan through Credible.

4) Parent Student Loans

Finding the best rates for private parent student loans can be challenging. Credible helps parents and guardians find the best student loans for their college/university-going children. Remember, this student loan is your responsibility, and getting the best repayment terms and rates is crucial.

5) Law Student Loans

A law degree can cost an arm and a leg. Credible provides excellent rates that match your Law degree program.

6) Medical School Student Loans

Are you looking to enroll in a medical school but don’t have enough funds? Credible can help you get up to $350,000 in medical student loans.

Credible Student Loan Lenders

Credible works with various student loan providers, like Ascent, Sallie Mae, Ascent, INvested, Custom Choice, College Ave, EDvestinU, MEFA, Citizens Bank, and more. This provides you with various student loan options, making it easy to compare and choose your provider within a short time.

Whether you prefer a fixed or variable student loan rate, Credible has many options for you. You don’t have to make endless and boring calls to one private student loan lender after the other. Also, Credible can help you find a provider that matches your repayment plan. College Ave, for instance, can be the best choice if you need to start paying off your loan while still studying.

Credible Student Loan Pros

- Free Student Loan Marketplace

Credible is an easy-to-use online loan marketplace for all your student loan needs. You can compare student loan offers from various lenders in one go. Also, when you use this platform, there are zero origination or processing fees or prepayment penalties. Credible is not a lender but an online marketplace that verifies and brings credible lenders to one place for you to select the best.

So how do they make money if it’s free for consumers? Credible gets small commissions when you close a student loan with one of its partner lenders.

- It is Easy to Apply

It takes three steps to get prequalifying student loan rates on Credible. You can get nearly instant real-time loan rates, saving you a lot of time.

- Zero Impact on Your Credit Score

You can pull accurate loan rates from multiple lenders without affecting your credit history. Credible makes a soft credit inquiry to help you get better and more accurate loan offers which

- Secure and no Spam

Nothing irks more than receiving endless spam emails and text messages from loan brokers you didn’t sign up with. Most spam messages happen because someone illegally gave your information to a third party. Credible uses secure 256-bit encryption and TLS security to protect your information.

- No Deadline to Apply for Private Student Loans

Credible deals with private student loans, and you can apply at any time. Application for Federal Student Aid, for instance, has time frames; once you miss them, you will have to wait for the next application window.

- You Can Use a Student Loan Cosigner

It can be hard to secure a loan without a credit history, but a cosigner with an excellent credit rating can help you. Your cosigners can create an account and add you on Credible.

- Excellent Options to Refinance Your Student Loan

Are you looking for better student loan refi options? Credible partners with refinance providers, and you could refinance a loan even if you didn’t graduate. You must meet minimum conditions to apply for a loan refinance. You must be over eighteen, a US citizen, or have a permanent residence with a minimum student loan of $5,000.

- Student Loan Options for International Students

Studying abroad can be quite expensive, and private student loans can help you. Credible can help you find a partner to finance your studies abroad. This money can fund your travel expenses, tuition fees, books, living expenses, and other qualifying school necessities. Remember, you’ll need a cosigner who is a US citizen or is a permanent resident to apply for private student loans on Credible.

Credible Student Loan Cons

Credible offers great benefits if you’re looking for the best loan that matches your needs. However, you’ll need to deal with a few drawbacks of this service. First, you’re not getting the student loan directly from Credible but independent third-party lenders, and you’ll have to research more and understand each lender’s terms and conditions.

Secondly, Credible doesn’t have the option to apply for federal student loans because they only partner with private lenders. You may not enjoy benefits like loan deferment, forgiveness, and other repayment options.

Should I Use Credible To Find Student Loans?

Credible can be an ideal option if you’re looking to compare multiple lenders side by side for private student loans. With a click of a button and a soft credit check inquiry, you can review up to ten lenders in one place. You should use Credible if you need a free and fast way to shop for student loan refinance online. It simplifies refinancing your student loan when you need to repay it faster.

How To Get A Student Loan On Credible?

You must follow a few steps to get your student loan through Credible. Visit credible.com and select student loans if you’re looking for private student loans. You can select student loan refinancing if you want to refinance your student credit.

Fill out your student form with personal information like your full name, phone number, address, date of birth, your university, course, graduation date, employment status, etc. Once you enter this prequalifying information, you’ll be redirected to create your profile and review offers. At this point, your best rate guarantee of $200 stands, and you can get it if you don’t find the best rate.

Once you signup, you can complete your loan process by selecting your lender. You’ll be redirected to the lender’s website, where you can apply for your student loan. Note that this is the stage where your creditor can make a hard inquiry to confirm your credit score.

What Are The Student Loan Repayment Options On Credible?

Since Credible only provides a student loan comparison tool, you can expect the repayment options to differ from one lender to the other. Depending on your lender, your student loan term can range from five to twenty years.

The rates and monthly payments can also vary depending on your lender and the loan product you take. Some Credible partners can offer rate discounts, deferment, forbearance, and other loan benefits. You need to prequalify to check out some of these student loan benefits.

Invested, a lender through Credible, for instance, has loan terms ranging from five to fifteen years, a 2% graduation reward, discounts, and cosigner release. Technically, you can qualify for a 2% off your principal amount if you clear school within the first six years. You can release your cosigner after meeting a specific consecutive payment threshold.

Is It Hard To Get A Student Loan On Credible?

Credible offers the most straightforward loan comparison tool to help determine the best student loan to fund your higher education. If you have a qualifying credit score or a cosigner, getting a student loan on Credible can be pretty straightforward. You can get credit to cover up to 100% of your tuition fees and living expenses with various options.

Applying for a private student loan doesn’t have to be an uphill task. Loan comparison tools are the best way to weigh multiple offers, APR rates, and payment terms and lock in the best loan offer.

Are you ready to shop for your student loan or get the best refi option? Visit Credible and select from the many options they offer.

Credible student loan review is one of our growing coverage on student loans. Sign up for our newsletters; we will send student loan tips straight to your inbox.